The sharp correction of the last two days is a reminder of how inherently unstable markets are. The trigger, a larger than expected increase in Average Hourly Earnings in the US, cannot itself explain such a violent gyration.

In fact, US Treasury yields have been steadily rising since the summer (see graph below), when macro data clearly evidenced a positive economic momentum globally. With all major economies running at or close to full potential, and little slack in the labor market, higher real interest rates were to be expected.

Overall, market observers have been circumscribing the problem of rising yields in the bond market, and have expected equities to continue performing positively on the back of earnings growth from a stronger economy. But you cannot have your cake and eat it, and if rates rise faster than earnings, a compression in P/E multiples becomes unavoidable.

However, none of this can explain the violence of the sell-off during the past few days. The explanation rather points towards a combination of technical factors (stop-losses, automated trades) behind the speed of the fall at the end of Monday’s trading session.

As we do not see any fundamental reason that would support a crash, we recommend to stay calm and take some time to assess whether the “goldilocks scenario” is dead and we are moving into reflationary territory, or if this is just a much needed correction whilst the market digests how to price in a higher interest rate environment.

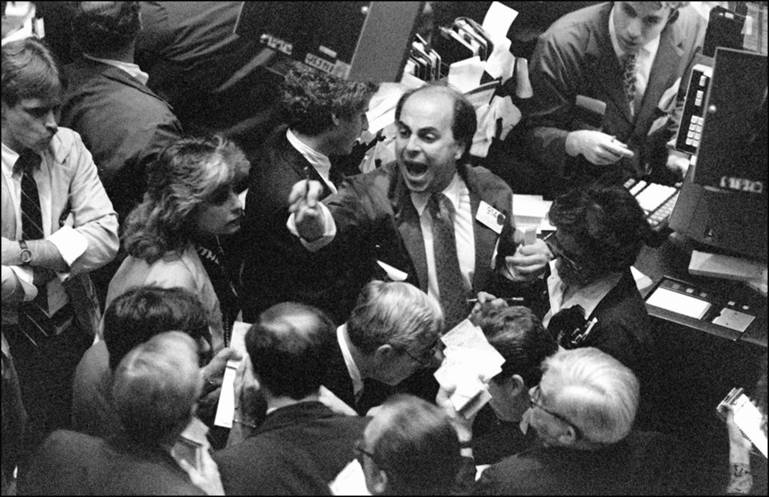

Shortly after Alan Greenspan took over the reins at the Fed, he was confronted with the “Black Monday Crash”, when the Dow inexplicably dropped by 22.6%. Just getting off a plane, he released the following statement “The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system”.

This helped to reassure markets and avoid an economic crisis. However, it gave birth to an era of investor dependency on central banks; something that has only worsened over the years. On Monday, Jerome Powell was sworn-in as the new Fed chairman, so it will be interesting to see his response to his first major “crisis”.

Dr. Fernando de Frutos

Chief Investment Officer, Boreal Capital Management AG

This document is for information purposes only and does not constitute, and may not be construed as, a recommendation, offer or solicitation to buy or sell any securities and/or assets mentioned herein. Nor may the information contained herein be considered as definitive, because it is subject to unforeseeable changes and amendments. Past performance does not guarantee future performance, and none of the information is intended to suggest that any of the returns set forth herein will be obtained in the future. The fact that BCM can provide information regarding the status, development, evaluation, etc. in relation to markets or specific assets cannot be construed as a commitment or guarantee of performance; and BCM does not assume any liability for the performance of these assets or markets. Data on investment stocks, their yields and other characteristics are based on or derived from information from reliable sources, which are generally available to the general public, and do not represent a commitment, warranty or liability of BCM.