Making sense of AI, equity valuations, and how to avoid a bubble

BY FERNANDO DE FRUTOS, CFA, PhD | OCTOBER 2025

CIO of Boreal Capital Management AG

- AI and Market Psychology: The surge in AI-driven investment is reshaping expectations across markets, yet valuations outside the hyperscalers remain surprisingly anchored. Investors may still be underpricing the magnitude—and breadth—of the coming transformation.

- Optionality vs. Hype: Technological change expands uncertainty, but it also raises the value of “real options”. The task for investors is not to predict the future, but to position for asymmetry—capturing AI’s upside without succumbing to speculative excess.

- Portfolio Positioning: In an era of exponential innovation, conventional diversification may fall short. A pragmatic barbell strategy—combining exposure to AI leaders with the underappreciated optionality in the broader market—offers the most balanced way to participate in progress.

There is a charged tension in the markets — the sense of energy accumulating before a storm. The surge of AI breakthroughs and the frenzy of capital pouring into computing power have no precedent. The question for investors is not whether that superficial tension will break, but how: in the form of a bubble that bursts into the air, or a volcanic eruption — a force that disrupts the surface yet expands the landscape beneath.

The Age of Hyperscalers

Large Language Models are moving up the value chain with uncanny speed, following the same path that emerging economies once used to converge with industrialized nations. ChatGPT, Gemini, and their peers now perform at expert levels — writing code, passing professional exams, and increasingly mastering human domains once thought unreachable by machines.

The world’s largest technology companies are racing to build data centers at a pace reminiscent of the 19th-century railroad boom. It is frontier land again—governed by the old mantra, “Build it, and they will come.” Governments have joined the race with wartime intensity. Export controls on advanced microchips now resemble arms embargoes: ASML’s most sophisticated lithography systems shipped to Taiwan include remote-disable features—à la “Mission: Impossible”—to prevent their capture in the event of a Chinese invasion. In the U.S., the government has even taken a strategic stake in Intel—a quasi-nationalization that would have been unthinkable in the pre-AI era.

Corporate maneuvers are equally extraordinary. Cross-shareholdings, strategic alliances, and massive capital outlays have made the sector look increasingly like Japan’s keiretsu conglomerate system before the 1980s bubble. Nvidia invests billions in its own clients, Microsoft bankrolls OpenAI while competing with it, and hyperscalers are at once each other’s customers and suppliers. Such “circularity” amplifies both innovation and fragility.

If AI Stalls

If AI proves slower to commercialize than hoped — if models plateau or energy costs cap scalability — the fallout could be substantial. Hyperscalers would face massive write-downs on projects tied to what is now a $7 trillion global capex wave, shaving points off GDP and investor optimism alike.

The good news is that AI revenues still represent only a small share of median corporate earnings, with most growth concentrated in a handful of hyperscalers. A disappointment would likely trigger a cyclical correction rather than a systemic crisis—a 20–30% drawdown typical of recessions. As in past waves of innovation, setbacks tend to delay, not derail, progress. The dot-com era ended painfully for investors but brilliantly for civilization: the internet kept its promise once valuations collapsed. AI may do the same.

If AI Erupts

The alternative is far more explosive. If AI continues advancing — if it truly augments or even surpasses human intelligence — then we are not just talking about incremental productivity. We are talking about a step change in the very rate of knowledge creation.

Economists typically model technological progress as an exogenous variable, but AI could make it endogenous — technology that improves technology. In that case, the upper bound for earnings growth dissolves, and equity valuation becomes an exercise in philosophical speculation: What multiple do you assign to infinite learning?

The potential implications of reaching the technological singularity—the point at which machine intelligence surpasses human cognitive capacity—are so immense that fears of social disruption are understandable. We will need rules, ethics, and perhaps humility to manage what we are unleashing. Yet even if we are closer to that theoretical inflection point than anyone could have imagined just a few years ago, it remains highly unlikely to occur within the typical five-to-ten-year investment horizon in which portfolios are managed. As John Maynard Keynes famously remarked, “in the long run we are all dead.”

In the meantime, investors should not fear AI as a threat to humanity, but rather embrace it as an insurance policy for it. Until the day machines can vote or hold a bank account, humans remain the parents—guardians and beneficiaries—of a wunderkind whose genius we are only beginning to discover.

Valuations and Optionality

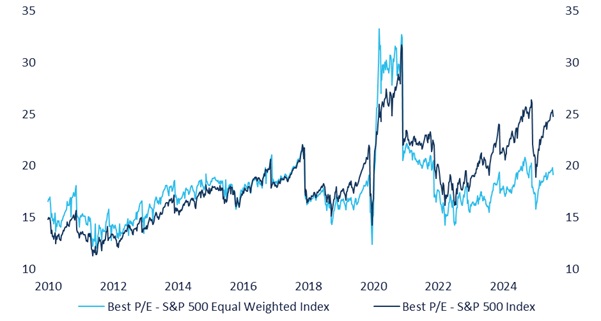

So how should investors approach valuations under this dual regime of fear and wonder? First, recognize the asymmetry. Unlike the dot-com boom, AI exuberance is concentrated, not generalized. The optionality of artificial intelligence is priced into microchip producers and hyperscalers, but barely reflected in the rest of the market. The S&P 500 Equal-Weighted Index — a better proxy for the average stock — trades today at a price-to-earnings ratio of around 20×, almost identical to its long-term average. In other words, there is no generalized bubble — only pockets of it.

Second, understand the nature of that optionality. Every stock can be thought of as the sum of two components: the going concern (the cash flows we can forecast) and the option on the unknown. Technological revolutions expand the latter. Companies like Tesla, or Nvidia itself, trade at valuations that embed this optional value — the right, not the obligation, to change the world again.

Conclusion: Forget Diversification (for Now?)

Technological breakthroughs always bring more uncertainty. And uncertainty, paradoxically, increases the value of “real options” while eroding the precision of traditional valuation metrics. That is not a flaw—it is the price of progress.

The challenge for investors is to capture the optionality without overpaying for the hype. The S&P 500 Equal-Weighted Index serves as a good thermometer of how much exuberance is priced into equities — and today, it shows surprisingly little, perhaps a lingering trauma from the dot-com bubble. That caution now looks excessive. Even with today’s level of technology, it is hard to imagine that AI will not lift all boats, improving corporations’ cost structures and revenue bases in the years ahead — and far more so if the technology keeps surprising us.

With the Fed shifting toward rate cuts, fiscal policy remaining expansionary, and earnings still growing even without an AI tailwind, the macro backdrop looks increasingly constructive. Combine that with the sheer magnitude of the technological opportunity, and the result is a risk-return profile skewed in favor of equities.

Of course, the old market adage still applies: “It’s never a good time to buy equities.” The price of this positive asymmetry is abandoning the comfort of investors’ rulebooks. One of their maxims—“never put all your eggs in one basket”—sits uneasily with the exceptional nature of the moment.

The pragmatic approach may be a barbell strategy: on one side, the cheap optionality embedded in non-tech stocks; on the other, the insurance value of being exposed to the companies leading the AI rollout. We are undoubtedly making history from a technological standpoint — but from an investor’s point of view, only time will tell whether “this time is really different.”

Investment advisory products and services, are provided by Boreal Capital Management LLC, an investment adviser regulated by the Securities and Exchange Commission; investment products, trade execution and other services may be offered by Boreal Capital Securities LLC, a member of the FINRA and SIPC. Boreal Capital Management LLC and Boreal Capital Securities LLC are subsidiaries of Boreal Capital Holdings LLC.

Boreal Capital Holdings LLC, Boreal Capital Management LLC and Boreal Capital Securities LLC, their affiliates, and the directors, officers, employees and agents (collectively, “Boreal”) are not permitted to give legal or tax advice. While Boreal can assist clients in the areas of estate and financial planning, only an attorney can draft legal documents and provide legal services and advice. Clients of Boreal should consult with their legal and tax advisors prior to entering into any financial transaction or estate plan. The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but Boreal makes no representation or guarantee as to their timeliness, accuracy or completeness or for their fitness for any particular purpose. The information contained herein does not purport to be a complete analysis of any security, company, or industry involved. This material is not to be construed as an offer to sell or a solicitation of an offer to buy any security. Opinions and information expressed herein are subject to change without notice. Boreal and/or its affiliates may have issued materials that are inconsistent with, or may reach different conclusions than, those represented in this document, and all opinions and information are believed to be reflective of judgments and opinions as of the date that material was originally published. Boreal is under no obligation to ensure that other materials are brought to the attention of any recipient of this document.

The information and material presented herein are for general information only and do not specifically address individual investment objectives, financial situations or the particular needs of any specific person who may receive this presentation. Investing in any security or investment strategies discussed herein may not be suitable for you, and you may want to consult a financial advisor. Nothing in this material constitutes individual investment, legal or tax advice. Investments

Legal DisclaimerBoreal Capital Management LLC,Boreal Capital Securities LLC and Boreal Capital Holdings LLC

Investment advisory products and services, are provided by Boreal Capital Management LLC, an investment adviser regulated by theSecurities and Exchange Commission; investment products, trade execution and other services may be offeredby Boreal CapitalSecuritiesLLC, a member of the FINRA and SIPC. Boreal Capital Management LLC and Boreal Capital Securities LLC are subsidiaries of Boreal CapitalHoldings LLC.

Boreal Capital Holdings LLC,Boreal Capital Management LLC andBoreal Capital Securities LLC, their affiliates, and the directors, officers,employees and agents(collectively, “Boreal”) are not permittedto givelegal or tax advice. While Boreal can assist clients in the areas ofestate and financial planning,onlyan attorneycan draft legal documents and providelegal services and advice.Clients ofBoreal shouldconsult with theirlegal and tax advisors prior to entering into any financial transaction or estate plan. Theopinions and informationcontained herein have been obtained or derived from sources believed to be reliable, but Boreal makes no representation or guarantee asto their timeliness, accuracy or completenessor for their fitnessfor anyparticular purpose. The informationcontained hereindoes notpurportto be a complete analysis ofany security, company, or industry involved. This material is not to be construed as anoffer to sell ora solicitation of an offer to buy any security. Opinions and information expressed herein are subject to change without notice. Boreal and/orits affiliates may haveissued materials that are inconsistent with, or may reach differentconclusionsthan, those represented in this document, and all opinions and information are believed to be reflective of judgments and opinions as of the date that material wasoriginally published. Boreal is underno obligationto ensure that othermaterials are broughtto the attention of any recipient of thisdocument.

The information and material presented herein are for general information only and do not specifically address individual investmentobjectives, financial situations or the particular needs of any specific person who may receive this presentation.Investing in any security orinvestment strategies discussedherein may not be suitable foryou, andyou may want to consult afinancial advisor. Nothingin this materialconstitutes individual investment, legal or tax advice. InvestmentsPast performance does not guarantee future results. Unless otherwise stated, the portfolios and its performances herein do not accountfor costs, fees and / or charges, haveno track record and have not been independently audited. Boreal shall accept no liability for any lossarising from the use of this material, nor shall Boreal treat any recipient of this material as a customer or client simply by virtue of its receipt.The information herein is not intended forany person residing in any jurisdiction in which it is unlawful todistribute this material.

Securities investments, products and services:

- Are not FDIC or Government Agency Insured

- Are not Bank Guaranteed • May Lose Value

- The information and materials presented here are notintended for persons in jurisdictions whereitis unlawful todistributesuch information and materials. For further information, please consult your legal advisor.

Past performance does not guarantee future results. Unless otherwise stated, the portfolios and its performances herein do not account for costs, fees and / or charges, have no track record and have not been independently audited. Boreal shall accept no liability for any loss arising from the use of this material, nor shall Boreal treat any recipient of this material as a customer or client simply by virtue of its receipt.

The information herein is not intended for any person residing in any jurisdiction in which it is unlawful to distribute this material.

Securities investments, products and services:

- Are not FDIC or Government Agency Insured

- Are not Bank Guaranteed • May Lose Value

- The information and materials presented here are not intended for persons in jurisdictions where it is unlawful to distribute such information and materials. For further information, please consult your legal advisor.

Legal Disclaimer Boreal Capital Management AG

Investment advisory products and financial services are provided by Boreal Capital Management Ltd (“Boreal”), a Swiss external asset manager regulated by the SRO AOOS.

Boreal Capital Management Ltd is not permitted to give legal or tax advice. Only an attorney can draft legal documents and provide legal services and advice. Clients of Boreal should consult with their legal and tax advisors prior to entering into any financial transaction or estate plan.

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but Boreal makes no representation or guarantee as to their timeliness, accuracy or completeness or for their fitness for any particular purpose. The information contained herein does not purport to be a complete analysis of any security, company, or industry involved. Opinions and information expressed herein are subject to change without notice. Boreal and/or its affiliates may have issued materials that are inconsistent with or may reach different conclusions than those represented in this document, and all opinions and information are believed to be reflective of judgments and opinions as of the date that material was originally published. Boreal is under no obligation to ensure that other materials are brought to the attention of any recipient of this document. Boreal accepts no liability whatsoever and makes no representation, warranty or undertaking, express or implied, for any information, projections or any of the opinions contained herein or for any errors, omissions or misstatements in the document. Boreal does not undertake to update this document or to correct any inaccuracies which may have become apparent after its publication.

This material is not to be construed as an offer to sell or a solicitation of an offer to buy any security nor a solicitation to buy, subscribe or sell any currency or product or financial instrument, make any investment or participate in any particular trading strategy in any jurisdiction where such an offer or solicitation would not be authorized or to any person to whom it would be unlawful to make such an offer or invitation. The information and material presented herein are for general information only and do not specifically address individual investment objectives, financial situations or the particular needs of any specific person who may receive this presentation. It does not replace a prospectus or any other legal document relating to any specific financial instrument which may be obtained upon request from the issuer of the financial product. In this document Boreal makes no representation as to the suitability or appropriateness of the described financial instruments or services for any recipient of this document nor to their future performance. Each investor must make their own independent decision regarding any securities or financial instruments mentioned in this document and should independently determine the merits or suitability of any investment. Before entering into any transaction, investors are invited to read carefully the risk warnings and the regulations set out in the prospectus or other legal documents and are urged to seek professional advice from their financial, legal, accounting and tax advisors with regard to their investment objectives, financial situation and specific needs. The tax treatment of any investment depends on your individual circumstances and may be subject to change in the future. Boreal does not provide any tax advice within this document and the investor’s individual circumstances were not taken into account when providing this document.

Investing in any security or investment strategies discussed herein may not be suitable for you, and you may want to consult a financial advisor. Nothing in this material constitutes individual investment, legal or tax advice. Investments involve risk and any investment may incur either profits or losses. The investments mentioned herein may be subject to risks that are difficult to quantify and to integrate into the valuation of investments. In general, products with a high degree of risk such as derivatives, structured products or alternative/non-traditional investments (such as hedge funds, private equity, real estate funds etc.) are suitable only for investors who are capable of understanding and assuming the risks involved. The value of any capital investment may be at risk and some or all of the original capital may be lost. The investments are exposed to currency fluctuations and may increase or decrease in value. Fluctuations in exchange rates may cause increases or decreases in your returns and/or in the value of the portfolio. The investments may be exposed to currency risks because a financial instrument or the underlying investment of a financial instrument is dominated in a currency different from the reference currency from the portfolio or other than the one of the investor’s country of residence.

This document may refer to the past performance of financial instruments. Past performance does not guarantee future results. The value of financial instruments may fall or rise. All statements in this document other than statements of past performances and historical facts are “forward-looking statements” which do not guarantee the future performance. Financial projections included in this document do not represent forecasts or budgets but are purely illustrative examples based on series of current expectations and assumptions which may not eventuate. The actual performance, results, market value and prospects of a financial instrument may differ materially from those expressed or implied by the forward-looking statements in this document. Boreal disclaims any obligation to update any forward-looking statement as a result of new information, future events or otherwise. The information contained in this document is neither the result of financial analysis within the meaning of the Swiss Banking Association “Directive on the Independence of Financial Research” nor of independent investment research as per EU regulation on MiFID provisions.

Unless otherwise stated, the portfolios and its performances herein do not account for costs, fees, commissions, expenses charged on issuance and redemption of securities or other, nor any taxes that may be levied and / or charges, have no track record and have not been independently audited. Boreal shall accept no liability for any loss arising from the use of this material, nor shall Boreal treat any recipient of this material as a customer or client simply by virtue of its receipt. The information herein is not intended for any person residing in any jurisdiction in which it is unlawful to distribute this material.

This document is confidential and is intended only for the use of the person to whom it was delivered. This document may not be reproduced in whole or in part or delivered to any other person without the prior written approval of Boreal.