Founded in 1856 by the Swiss railway pioneer Alfred Escher, Credit Suisse has long been seen as a symbol of everything good about Switzerland: Strong, efficient and stable. It is difficult to walk into a single urban area within the alpine country and not find a branch of the globally recognised brand. One of its main ambassadors is the greatest tennis star in history, Roger Federer, another Swiss rock.

However, a series of scandals in recent years has left its reputation in ruins, and investors and clients justifiably asking: just what is coming next? Since hitting a high of almost CHF85 per share in September 2000, the share price has dropped a staggering 98%, yesterday closing at a touch under CHF1.70. At the same time, the 5 years credit default swap (essentially an insurance agreement that compensates the holder against default) reached crisis levels, and cost 18 times that of Swiss rival UBS. That’s the difference between your car insurance costing $100, or $1’800 for essentially the same cover.

Hollywood Scandal

The list of accusations is seemingly endless: corporate espionage and spying on board members and former employees, a criminal conviction for allowing drug dealers to launder money, a chairman openly violating covid rules, and entanglement in a Mozambique corruption case.

In 2021, the bank was hit by investments in the British financial firm Greensill Capital, plus the US fund Archegos Capital Management (taking losses of CHF5.5billion).

At the same time, a report by FINMA accused the troubled bank of ignoring over 100 warnings of potential breaches of regulations in their thirst for profits.

The latest panic emanated after it was reported that the banks largest shareholders (the Saudi National Bank) said it would not buy more shares. However, as is typical with modern media, the announcement was sensationalised, and the full message not widely reported on. What the Saudi bank actually said was they would not be buying more shares as regulations would not allow them to hold more than 10% (they currently own 9.88%). They have since made further statements confirming that CS has not asked them for financial assistance, and that the market fear and panic is unwarranted.

Too Big to Fail?

This phrase will likely strike terror with many who all too well remember the financial crisis of 2008, with many believing that if banks take too much risk, they should be allowed to fail. However, the ramifications of a bank with the footprint of Credit Suisse failing are too scary to imagine. The Swiss banking system would be irreversibly damaged, and the global fallout would be huge. As at the end of 2022, the firm employed in excess of 50’000 people, with 16’000 in Switzerland alone, and CHF1.5 trillion of global client assets under management.

What next?

Fearing a bank run on deposits, the Swiss National Bank (SNB) and the country’s regulator FINMA moved swiftly to yesterday issue a joint statement in order to calm clients and investors alike:

“Credit Suisse’s stock exchange value and the value of its debt securities have been particularly affected by market reactions in recent days. FINMA is in very close contact with the bank and has access to all information relevant to supervisory law. Against this background, FINMA confirms that Credit Suisse meets the higher capital and liquidity requirements applicable to systemically important banks. In addition, the SNB will provide liquidity to the globally active bank if necessary. FINMA and the SNB are following developments very closely and are in close contact with the Federal Department of Finance to ensure financial stability.”

https://www.finma.ch/en/news/2023/03/20230315-mm-statement

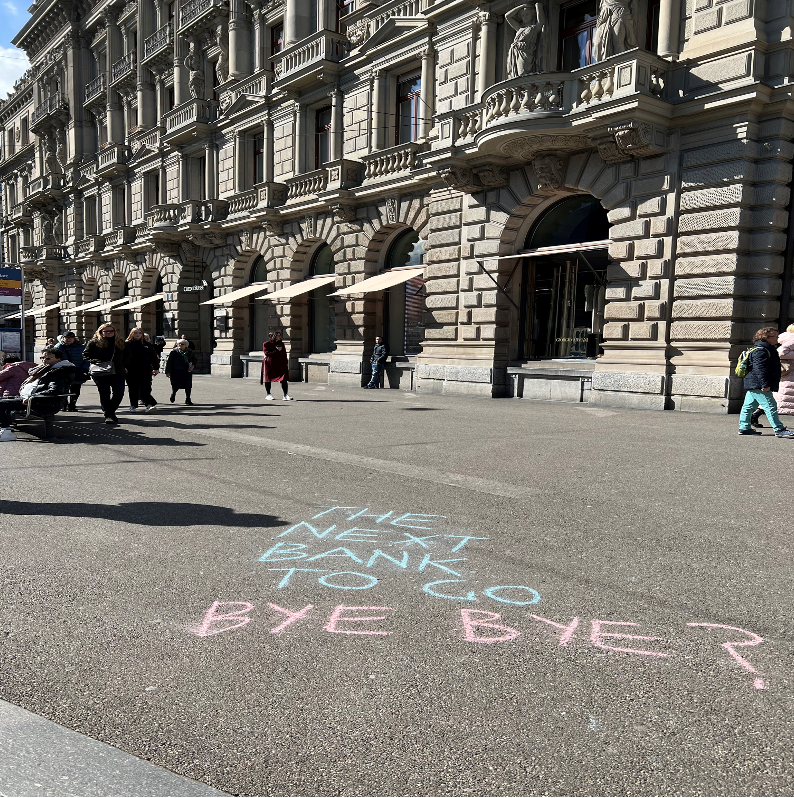

A member of the public makes their feelings clear outside Credit Suisse HQ in Paradeplatz, Zürich

Hours after the statement, Credit Suisse took the government up on its offer, stating that it would borrow up to CHF50 billion from the Swiss National Bank. In addition to the loan, the bank also said that they had repurchased $2.5billion of US dollar bonds and €500 million of euros bonds.

The move brought a lot of relief to markets, with shares trading up 20% in early Thursday morning trading on the Swiss stock exchange.

What does this all mean?

In summary, the Swiss authorities have made it clear that Credit Suisse really is too big to fail, and they will do everything in their power to ensure that it does not happen. However, one can imagine that the bank will look very different a year from now. Most of the problems have arisen from the investment banking arm, and it has already been announced last year that the US asset management arm is up for sale. This cull of “non-core” business will likely continue during 2023, and it is feasible that a large portion of the international business will be sold off, leaving behind the Swiss wealth management business. For now, this is all speculation.

The most important thing is that client deposits are, for the foreseeable future, seemingly safe.

Meanwhile, investors in CS bonds and shares should review their holdings and make sure they are comfortable with the risk they are taking.

Please contact Edwards Wealth Management AG to see how we can help.

Robert Edwards,

Managing Partner

Your success, our expertise